Big Role for 5G RedCap in 5G Evolution, Massive IoT Adoption

- 5G RedCap promises a mix of capabilities including improved throughput, extended battery life and less complexity to power diverse use cases cost-effectively.

- 5G RedCap (including eRedCap) modules are expected to contribute to one-fourth of total cellular IoT module shipments by 2030.

- 5G RedCap will serve use cases such as wearables, medical devices, video surveillance, industrial sensors and smart grid applications.

We have come a long way from the first generation (1G) to the fifth generation (5G) of cellular connectivity. Despite being in the initial stages of its rollout, 5G is poised for adoption at a speed not seen by previous cellular standards.

However, from the IoT perspective, 5G is being considered only for high-end applications due to the higher cost and existence of many use cases which need low power and low bandwidth, currently served by LPWAN. We can see the potential that 5G brings to IoT applications in terms of faster connectivity, low latency, reliability and large capacity compared to LTE networks. These benefits make 5G valuable for certain IoT use cases, creating a need for low-end 5G for the LPWAN application.

What are 5G RedCap and 5G eRedCap?

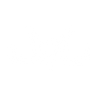

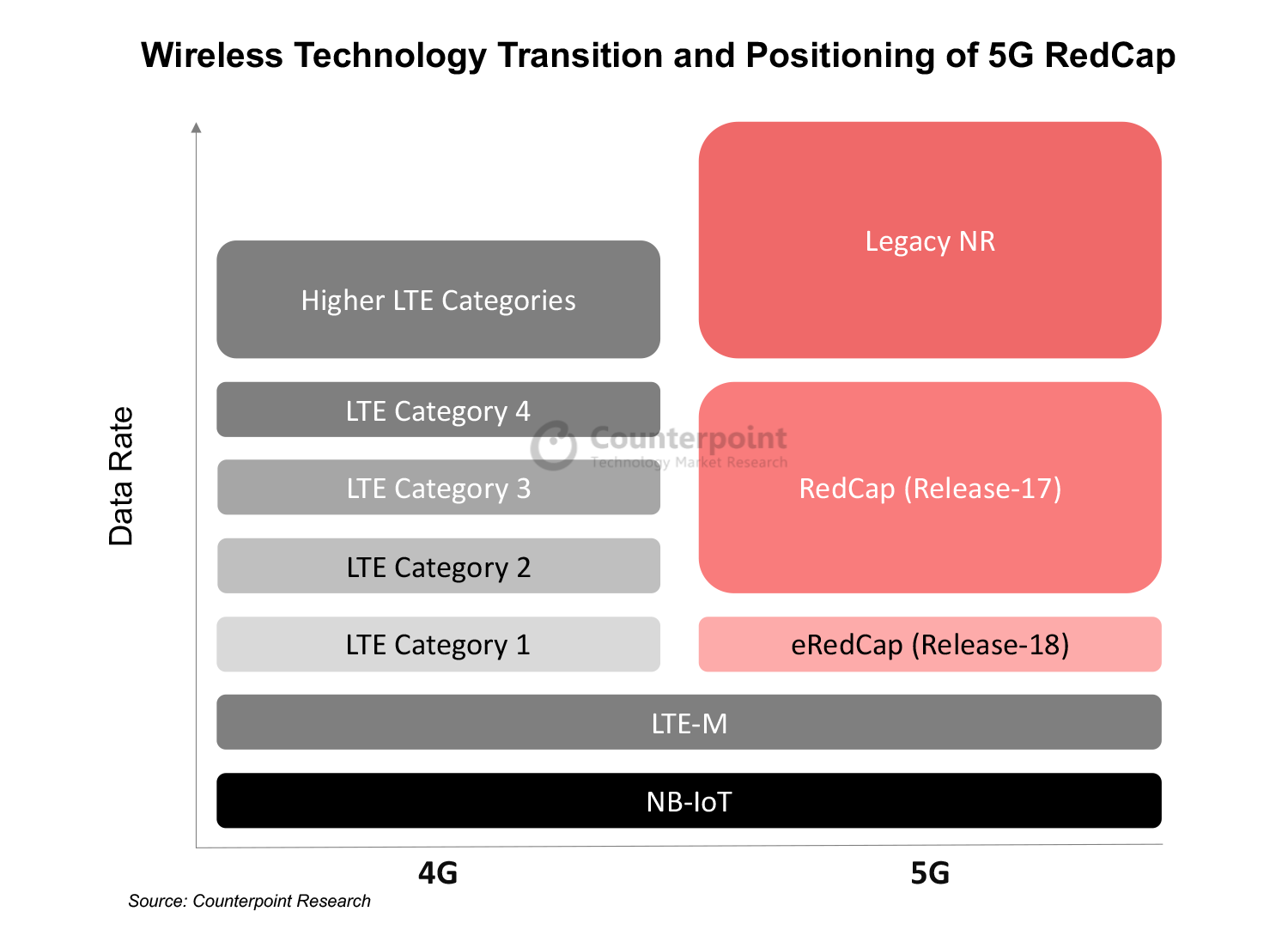

5G RedCap (Reduced Capacity), aka NR-Lite (New Radio-Lite), is a lighter version of the 5G standard that will cater to those use cases where ultra-low latency is not essential, but there is a need for reasonable throughput to support data flows in applications like router/CPE, mass-market automotive, POS and telematics devices, which are currently addressed by LTE Cat 4. In the upcoming 3GPP Release-18, there will be another version of 5G RedCap, called eRedCap (enhanced-RedCap), which will serve the use cases currently being served by LTE Cat 1 and LTE Cat 1 bis.

Market opportunity for 5G RedCap

5G RedCap addresses new use cases that cannot be served by advanced 5G standards like eMBB/URLLC and LPWAN. 5G RedCap chipset is already available in the market but we can expect commercial rollout by the first half of 2024. According to Counterpoint Research’s Global Cellular IoT Module Forecast, 5G RedCap modules will constitute 18% of total cellular IoT module shipments by 2030, indicating a significant market potential, particularly in developing nations where the cost is key to wide technology adoption for digital transformation.

The subsequent 5G eRedCap is planned for a 2024 introduction, with commercial availability likely by 2026. Expected to bring further innovations to the IoT segment, 5G eRedCap modules are projected to contribute 8% to the total cellular IoT module shipments by 2030.

During the transition phase, network operators will maintain IoT device support through the existing 4G network while focusing on 5G high-end applications like routers/CPE, XR/VR devices and automotive.

By the end of the decade, cellular IoT will generally migrate to 5G, driven by new use cases offered by the 5G network, with 4G serving as a fallback. The industry is already preparing for this shift, moving away from legacy technology towards newer standards.

5G RedCap ecosystem and applications

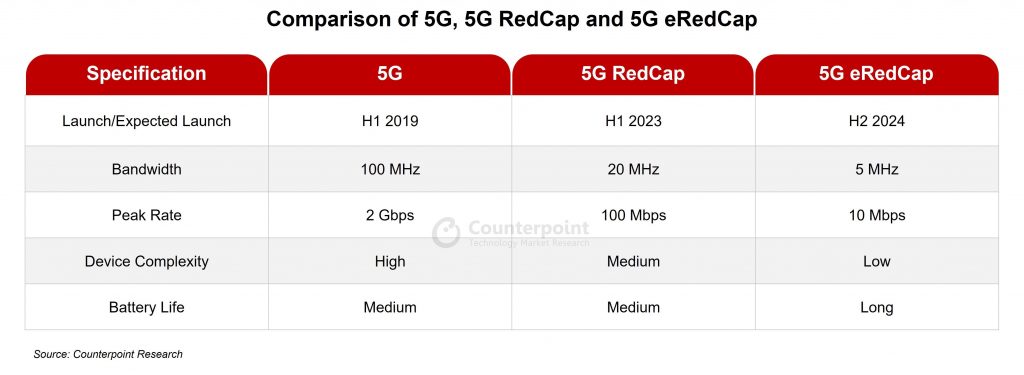

We can see a flurry of new announcements from ecosystem players to adopt the 5G RedCap standard. Module and chipset players are forging partnerships to capture the opportunity which will be created by 5G RedCap. Qualcomm always has been at the forefront when it comes to adopting new technologies with big potential. We can see that with its launch of the industry’s first SDX35 5G RedCap modem. Qualcomm’s early entry and partnerships with major module vendors will help it to grab more market share in 5G when the mass adoption of 5G RedCap will take place.

5G RedCap will serve the use cases in industrial, enterprise and consumer applications, like smart wearables, medical devices, XR glasses, health monitors, video surveillance cameras, wireless industrial sensors, utility/smart grid applications and even Fixed Wireless Access (FWA) and customer premises equipment (CPEs).

5G eRedCap is likely to be preferred for the applications served by 4G Cat 1, such as tracking devices, charging stations, micro-mobility and battery-powered sensors.

Conclusion

5G RedCap promises to broaden the 5G ecosystem, facilitating more connections. It fills the gap between LPWA and URLLC, simplifying 5G integration in IoT applications. 5G RedCap and eRedCap modules will be cost-effective, enabling OEMs to manufacture less complex, low-cost devices with lower power consumption, something that standard 5G cannot offer.

Though 5G at the IoT level is a few years out, vendors can create devices operable over LTE, with an easy switch to RedCap by changing the communication module. This allows immediate product deployment, with an easy future transition to 5G RedCap as the standard evolves.

5G RedCap’s flexibility and network advantages, including lower latency and higher speeds compared to previous LTE generations, position it as a superior choice for future mass IoT deployment. Numerous potential connections across consumer, industrial and enterprise verticals such as FWA, CPE and vehicle connectivity will greatly benefit, accelerating IoT adoption on a massive scale.

Related Reports:

- Quectel, Telit Cinterion, Fibocom Capture More Than Half of Cellular IoT Module Shipments in Q1 2023

- Global Cellular IoT Connections to Cross 6 Billion in 2030

- Global Connected Construction Machine Shipments Grew 6.7% YoY in 2022

- Global Connected Agriculture Node Shipments to Reach 187 Million Units by 2030

- White Paper: eSIM 2.0: Managing eSIM at Scale

- 5G Advanced and Wireless AI Set To Transform Cellular Networks, Unlocking True Potential

- AI/ML Key in Enhancing 5G Network Efficiency, Reducing Complexity

- White Paper: Growing 5G+Wi-Fi RF Complexity Demands Innovative, Advanced & Tightly Integrated RFFE Solutions

- Global Cellular IoT Smart Module Tracker – Q1 2023

- Global Connected Crop Farming Market – 2022

- Global Connected Livestock Monitoring Market – 2022

- Global Connected Car Tracker Q1 2019 – Q1 2023