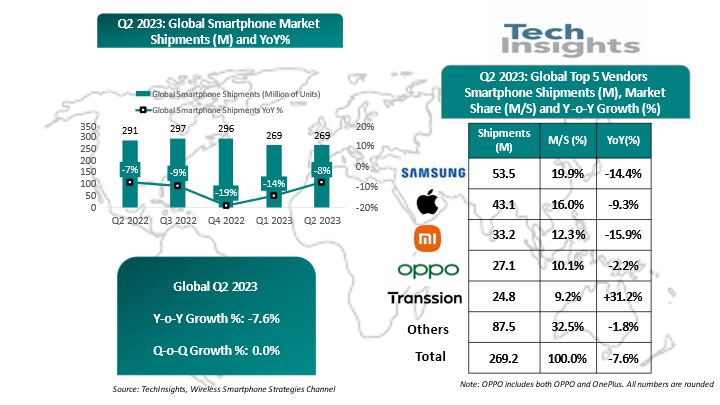

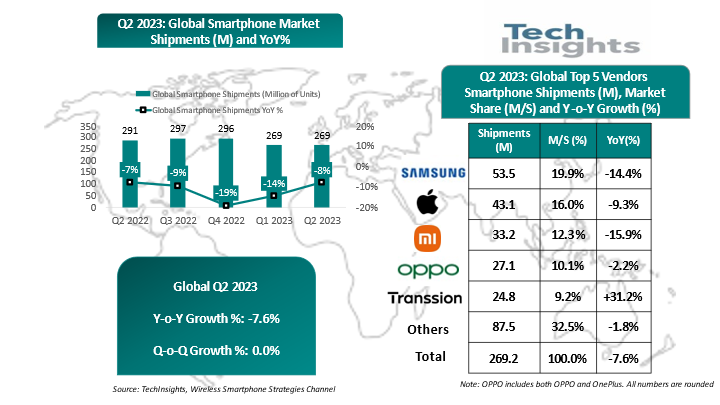

Global smartphone shipments in Q2 2023 were 269 million units, down 8% year-on-year

According to the latest research by TechInsights, global smartphone shipments in Q2 2023 fell by 8% year-on-year to 269 million units. Samsung topped the global smartphone market with a 20% market share, followed by Apple with a 16% market share, and Xiaomi, OPPO (including OnePlus), and Transsion ranked in the top five. This is the first time Transsion has entered the top five global manufacturers, largely due to its robust growth in Asia, Africa, and Central Latin America.

Q2 2023 marked the eighth consecutive quarter of annual decline in global smartphone shipments. Notably, the rate of annual decline has slowed, from double digits in the past two quarters to -8% this quarter, indicating that the smartphone market will see a mild rebound in the second half of 2023, coupled with the normalization of inventory levels and the upcoming holiday season, as well as several new product release cycles from major participants such as Samsung and Apple. This quarter, we saw significant changes in the rankings of smartphone manufacturers. Transsion became the fifth-largest smartphone manufacturer in the world for the first time, which is an extraordinary milestone for this Chinese company. Among the top five manufacturers, Transsion was the only supplier to achieve double-digit annual growth this quarter.

Samsung's smartphone shipments were 53.5 million, topping the global smartphone market with a 20% market share. Although the company's smartphone shipments fell by 14% year-on-year, its performance in terms of operating profitability was very robust due to stricter cost control and operational efficiency.

Apple shipped 43.1 million iPhones in the quarter, accounting for 16% of the market share. Apple's performance was slightly below the overall market, with shipments down 9% year-on-year. Apple's demand in North America, Western Europe, and Japan was lukewarm, mainly due to its mixed performance. This quarter, the iPhone performed well in emerging markets, especially in India, while its performance in China remained stable. TechInsights estimates that China surpassed the United States for the first time this quarter to become the largest single country for the iPhone, accounting for 24% of the share (ahead of the United States' 21% share).

Xiaomi's smartphone shipments were 33.2 million units, ranking third with a 12% global market share, down from 14% a year ago. Xiaomi's inventory in China and India has normalized this quarter, and the annual decline rate has slowed.

OPPO (OnePlus) ranked fourth, accounting for 10% of the global smartphone market share this quarter, with shipments down 2% year-on-year. The shipment volume of the OPPO brand alone reached 22.2 million units, down 11% year-on-year; OnePlus's quarterly sales reached 4.9 million units, up 81% year-on-year. The newly launched low-cost OnePlus Nord series performed strongly in India. At the same time, its Ace series continues to attract Chinese mobile game players.

Transsion (the sum of Tecno, itel, and Infinix brands) surpassed vivo for the first time this quarter to enter the top five. This Chinese brand focuses on the African, Middle Eastern, Asian, and Central Latin American markets, launching a large number of affordable smartphone models priced below $100 (wholesale price). The three brands shipped a total of 24.8 million units in Q2 2023, up 31% year-on-year, with a market share of 9%, up from 6% a year ago. Tecno and Infinix accounted for the majority of the share, while the itel brand focused on the lower-priced feature phone market. The company's improved inventory levels and a large number of new smartphone models launched in Africa, Asia, and Central Latin America were the main drivers of Transsion's strong performance this quarter.

In addition to the top five, the global competition among other major smartphone brands was also fierce in Q2 2023. vivo, Honor, realme, Lenovo-Motorola, and Huawei ranked in the top ten, but their performance this quarter was mixed:

vivo slipped to sixth place, with demand falling in all regions except the Middle East and Africa, and its total smartphone shipments have seen double-digit year-on-year declines for seven consecutive quarters.

Honor's impressive recovery journey also hit a speed bump, as it saw a year-on-year decline due to weak performance in the Chinese market in Q2 2023, but its overseas business has started to increase in recent months.

realme returned to eighth place this quarter with a 4% market share. However, realme still saw a double-digit annual decline and lost market share in Europe and the Asia-Pacific region.

Lenovo-Motorola ranked ninth with a 4% market share. Shipments fell 13% year-on-year, with sales in the Americas plummeting due to the slow product release cycle of major postpaid carriers in the United States and fierce competition from other Chinese brands in Latin America. Its newly launched flip-fold screen series razr 40 will help Motorola regain market share and stabilize performance for the rest of the year.

Huawei maintained its position in the top ten, with smartphone shipments achieving double-digit annual growth this quarter, largely thanks to its resilience in China. Driven by the newly launched Nova 11 series, Huawei achieved a 25% annual growth in China. We noticed that Huawei's 4G products still appeal to its loyal fans in the domestic market. In addition, the Middle East region has become Huawei's new overseas growth engine in recent quarters. Rumors suggest that Huawei will return to the 5G smartphone market in China in the second half of this year, possibly bypassing US sanctions through its own 5G chipset. While we are cautious about the cost and performance of any self-developed 5G chipset, if the rumor is true, it will provide momentum for Huawei's unexpected recovery journey in the domestic market.

Among the top ten global smartphone manufacturers, eight are Chinese brands. The total annual shipments of all these Chinese brands fell by -5%, slightly better than the overall market. This is an improvement from the previous quarter, indicating that the entire market may see a recovery in the second half of this year.

TechInsights predicts that global smartphone shipments will continue to decline, with an expected year-on-year decline of 5% for the whole of 2023. Geopolitical issues, economic uncertainty, inflation, and price increases will continue to affect global consumer demand in the second half of 2023. A moderate annual decline is expected to begin in the third quarter, and the fourth quarter should see high single-digit growth during the Christmas holiday season. Samsung and Apple will continue to hold the top two positions. Chinese brands performed stably this quarter, but they will continue to struggle on the road to recovery for the rest of the year.